28

2020

-

06

These enterprises are becoming the "vampires" of the Chinese economy!

Author:

Great in the Jianghu

Reprinted from the WeChat official account of Jianghu Dada

On June 14th, a shocking kidnapping case occurred across the country. He Hejian, the founder of Midea Group, was kidnapped by five gangsters claiming to be carrying explosives in his villa in Midea Junlan Life Village.

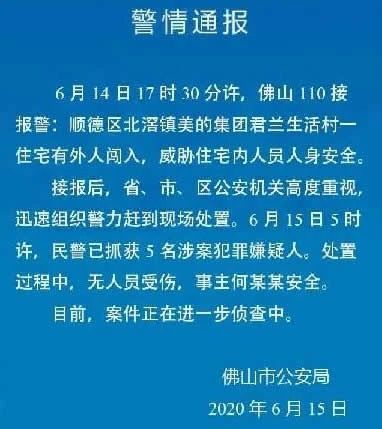

Due to the proper handling by the police, the He Hejian family was unharmed. On June 15, the police of Foshan Public Security Bureau issued a notice that the police had captured five suspect involved in the case. No one was injured during the handling process, and the victim was safe.

It has been 24 years since Zhang Ziqiang kidnapped Victor Li, the son of Li Ka shing. In these 24 years, there have been basically no vicious incidents of bandits kidnapping wealthy individuals. In China, the justice of heaven is vast and there is no negligence.

Kidnapping a wealthy person is almost equivalent to death.

Just when everyone couldn't believe that there were still such foolish bandits, a so-called insider said, "The people who participated in the kidnapping were not bandits, but Midea's suppliers. Due to the long-term inability to settle the payment and borrowing high interest loans, they couldn't survive

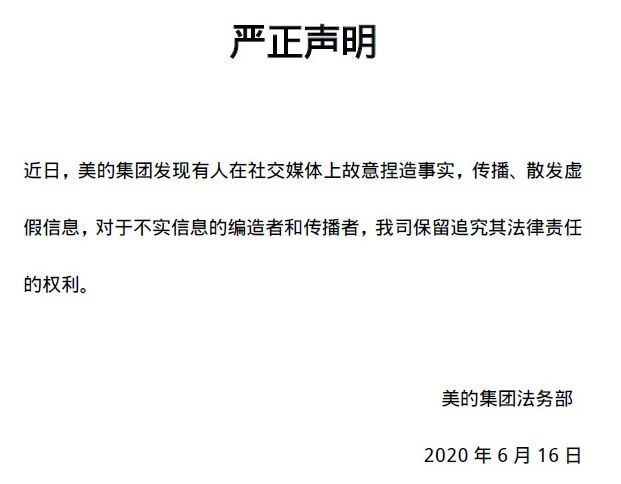

This news has been widely spread in the WeChat group, and Midea Group has also urgently refuted the rumor. On June 16th, it issued a solemn statement: Someone intentionally fabricated facts on social media, spread or disseminated false information.

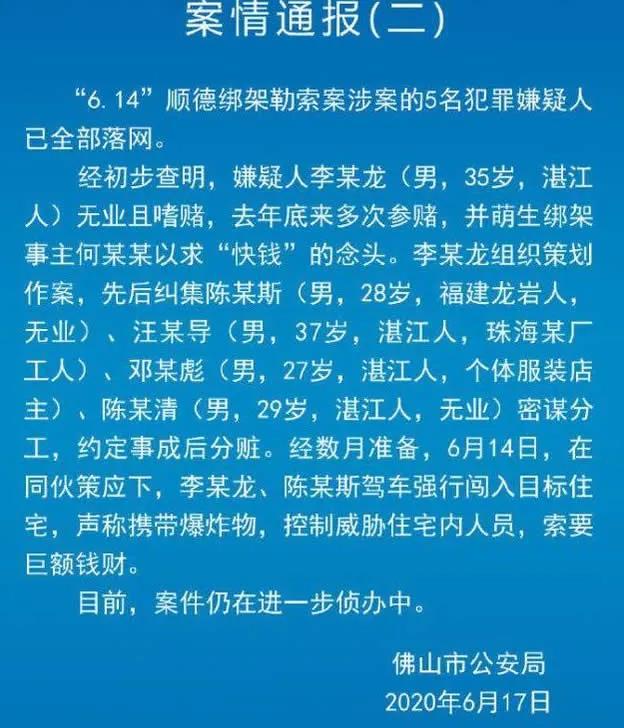

Netizens are still skeptical. On June 17th, the Foshan Public Security Bureau once again issued a case report: five suspects conspired to divide the work and agreed to share the spoils after the incident was completed. After months of preparation, on June 14th, they forcibly broke into the target residence, claiming to be carrying explosives, controlling and threatening the people inside the residence, and demanding huge amounts of money.

Why is it associated with a supplier in a heinous kidnapping case by a bandit? Is this completely groundless or is there a hidden mystery?

Next, let's take a peek at the inside story!

Some people may ask, isn't taking deposits and issuing loans done by banks?

you 're right! A financial company is essentially a financial institution, and its establishment requires approval from the China Banking Regulatory Commission. But it is not a bank, it can only absorb deposits from group members and cannot absorb personal deposits like a bank, so it is a non bank financial institution.

Someone may ask again, what is the relationship between your talk about this financial company and the topic we are going to talk about today?

Now, let's get to the main topic and slowly help everyone clarify the logic.

Let's make a hypothesis that there is a large manufacturing company called Niu B Group, with annual revenue of hundreds of billions and profits of tens of billions. The brand is well-known nationwide, so it is very Niu B.

The annual procurement volume of NiuB Group is large, exceeding 100 billion yuan. Many small and medium-sized enterprises are breaking their skin to do business with it and competing for supply.

Niu B Group said to the suppliers: Since you all want to do business with me, I was originally given a one month payment period, so now we can supply for two months, and I will pay you for the goods.

Suppliers must agree, otherwise business won't have to be done. If you don't do it, there will be a lot of people waiting in line behind you.

After a period of time, Niu B Group was dissatisfied again and said to the suppliers, 'Okay, I won't send you the remittance in two months.'. I will give you a 6-month bank acceptance draft. After the 6-month maturity, you can go to the bank to collect the money.

The suppliers are feeling uncomfortable now. Originally, I could receive payment in 2 months, but now it has become 8 months. But there's no way, business still needs to be done.

The supplier suddenly ran out of funds. In order to get the money as soon as possible, they can take this 6-month bank acceptance bill and go to the bank to discount interest and exchange it for cash.

For example, if you receive a 6-month bank acceptance bill of 1 million yuan, in order to receive cash as soon as possible, the bank can immediately offer you 970000 yuan at a 3% discount.

The supplier had already made a meager profit, but as a result, they were deducted 3%.

After another period of time, Niu B Group said to the supplier again, "Okay, after 2 months, I won't give you a 6-month bank acceptance draft. I have a Niu B finance company below, and I will give you a 6-month commercial acceptance draft issued by them. After 6 months, you can go to NiuB Finance Company to collect the money.

Suppliers are so foolish. The commercial acceptance draft issued by NiuB Finance Company is not recognized by the bank, and you cannot take it to the bank for discount.

What should I do if I need money urgently now?

NiuB Finance Company said to the supplier, 'You can come to me for a discount. It's very favorable, with a 6% discount rate.'.

Suppliers have no choice but to go out to private short-term loans, with a minimum of 1.5% per month and 9% for half a year. After calculation, it is better to go to NiuB Finance Company for discount.

The supplier's 1 million yuan commercial acceptance bill instantly turned into 940000 yuan, making their life even more difficult.

The supplier complained to NiuB Group that we are struggling, with low profits and long payment periods, and we are short of cash to turn around.

Niu B Group said to the supplier, 'I don't have any money, right? From supplying to I giving you a draft, I have accumulated a lot of accounts receivable in the past two months.'. In this way, I would like to introduce you to a new friend, Niu B Financial Company, which we have established. You can mortgage these accounts receivable to Niu B Financial Company, which will lend you money at a monthly interest rate of 1%. After the time comes, I'll just transfer the accounts receivable to the financial company.

The supplier said, 'Okay, okay, that's really great. This financial tool is really delicious and has activated my accounts receivable. Thank you very much.'.

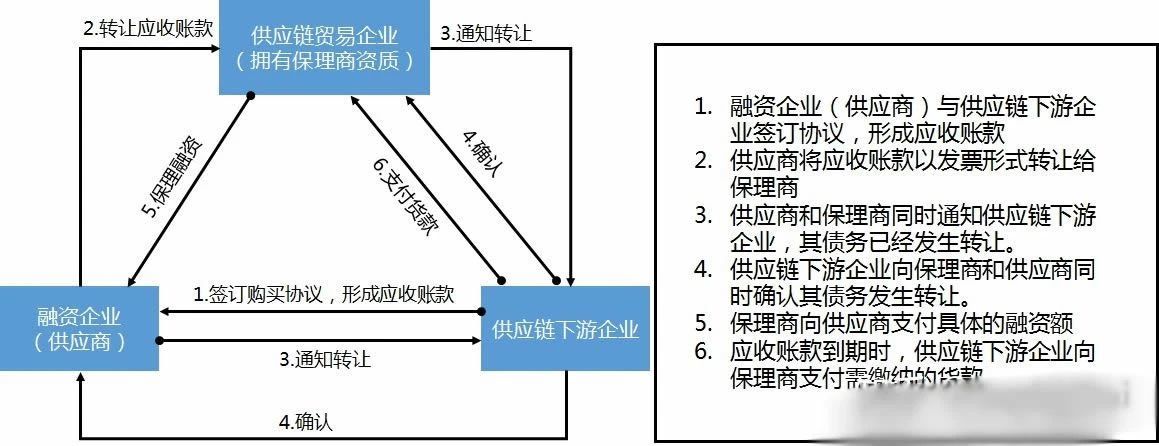

Accounts receivable financing flowchart

Accounts receivable financing flowchart

That's right, reality is so absurd.

Originally, in business, it was all about paying and delivering, but large enterprises have too much say, and small and medium-sized enterprises have to compromise on payment terms. This has led to difficulties in the turnover of funds for small and medium-sized enterprises, while large enterprises have established financial companies and financial companies to provide bill discount services to suppliers. And invented financial tools such as accounts receivable mortgage loans, and took a lofty name called "supply chain finance", which is called "helping small and medium-sized enterprises solve financing difficulties".

What are the root causes of financial difficulties for small and medium-sized enterprises? The root cause is forced by large enterprises!

A normal enterprise will give distributors a payment period. For example, if the enterprise sells goods to distributors, the distributors will pay 30% in advance, and the remaining 70% will be paid within one month after shipment.

The brand awareness of large enterprises is very high, and many dealers are rushing to act as agents. Niu B Group said to the dealers: Starting today, we will pay the full amount first and then ship the goods. Why don't you do it?

The dealers said, 'Brother, we can't do it. We don't have so much working capital to pay the full amount.'.

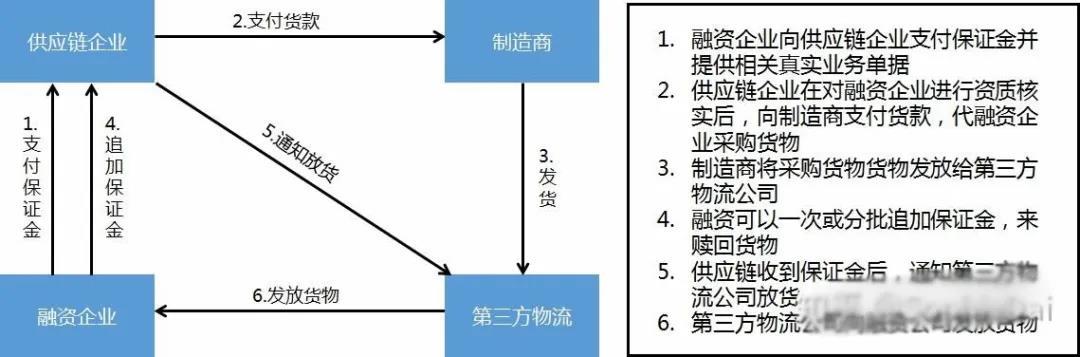

Niu B Group said to the dealer: I will introduce our financial company to you. If you give it a deposit, they will pay me the full payment for the goods. It's equivalent to my financial company providing you with a loan with a monthly interest rate of 1%. You can pick up as many goods as you sell from their warehouse, and return the money to the financial company once you receive it.

This has happened again to the absurd thing that happened earlier. Originally, the company should have provided dealers with certain accounting period support, but the big company had too much say and directly cancelled the accounting period. Then a financial company was established to provide advance payment financing to distributors, and to earn interest from small and medium-sized enterprises.

Advance Payment Financing Flowchart

In fact, if large enterprises can make payment to suppliers as soon as possible and reduce the prepayment of distributors, it can minimize the financial pressure on small and medium-sized enterprises.

But for these large enterprises, why should I give you the money I owe you so early? Why should I give you an account period for the money I can recover as soon as possible based on my strength? I will deposit this money with my finance company and then lend you a "blood sucking" loan. Isn't it fragrant?

Establish a financial company, use your money, regenerate money, lie down and make money, and earn profits; Providing loans to small and medium-sized enterprises to solve their financing difficulties has earned them a reputation. Isn't it beautiful to have both fame and fortune, and to eat two fish at a time?

The most tragic situation is for small and medium-sized enterprises in the upstream and downstream, who dare to be angry and dare not speak up.

Some people will say that small and medium-sized enterprises can avoid doing their business. But that's easy to say. Where else can we find such a big customer after losing them? How many customers in China are there that exceed one hundred billion?

So, big enterprises and small and medium-sized enterprises are willing to fight one by one.

After the establishment of these financial companies, they were nominally financing small and medium-sized enterprises, but in reality they became the "vampires" of the Chinese economy.

Why did the rumor mentioned at the beginning of the article appear? You taste it carefully!

group,Digital automation,Finance Company

Previous

Previous